does texas have inheritance tax 2021

12Heres why it starts so late. However California is not among them.

What Is Inheritance Tax And How Much Is It

Inheritance tax in texas 2021 January 20 2022 January 20 2022 January 20 2022 January 20 2022.

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

. Fortunately Texas doesnt have an estate tax and is one of the dozens of states without it. 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger. Property Taxes in Texas.

However in Texas there is no such thing as an inheritance tax or a gift tax. The exemption was 117 million for 2021 Even then youre only taxed for the portion that exceeds the exemption. The tax rates listed below have already been reduced by the applicable rate reduction for decedents dying on or after January 1 2021 but before January 1 2022 and should be used in the computation of shares for each beneficiary of the inheritance tax owed.

North dakota to certain place emphasis on top of inheritance waiver and made a waiver of cases and now faced with both on board to take for. Even though Texas does not have an estate or inheritance tax there are instances when such taxes are applied to inheritances in Texas. You might owe money to the federal government though.

Each are due by the tax day of the year following the individuals death. Iowa has an inheritance tax but in 2021 the state decided it would repeal this tax by 2025. Final individual federal and state income tax returns.

People often use the terms estate tax and inheritance tax interchangeably when in fact they are distinct types of taxation. Gift Taxes In Texas. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

Regardless of the size of your estate you wont owe estate taxes to the state of Texas. First there are the federal governments tax laws. The estate tax starts at 18 and goes up to 40 for those anything over the 234 million threshold.

The District of Columbia moved in the. Trenton to texas divorce forms do not fill one form to the waiver may not in. There are no inheritance or estate taxes in Texas.

The potential INCOME tax rate on that built in gain even if all of it is classified as a capital gain is 26 20 federal. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. You can give a gift of up to 15000 to a person without having to pay a.

The federal estate tax only kicks in at 117 million for deaths in 2021 and 1206 million in 2022. The state repealed the inheritance tax beginning on September 1 2015. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

In texas constitution inheritance tax form is going through. With proper tax planning and estate planning you have the ability to pass an estate much larger than this without being subject to the federal estate tax. It operates almost like an inheritance tax on the heirs but it is much more severe and it is levied through the INCOME TAX SYSTEM.

In fact Texas does not require either an estate tax levied on the estate you leave behind or a death tax any tax imposed on the transfer of property upon your death. The tax rate varies depending on the relationship of the heir to the decedent. Inheritance taxes in Iowa will decrease by 20 per year from 2021 through 2024.

That said you will likely have to file some taxes on behalf of the deceased including. The short answer is no. Theres no estate tax in Texas either although estates valued at more than 1206 million can be taxed at the federal level as of 2022.

There are not any estate or inheritance taxes in the state of Texas. However other stipulations might mean youll still get taxed on an inheritance. For deaths that occur.

As of 2021 the federal estate tax only kicks in once the deceaseds estate is valued at above 117 million. There is no federal inheritance tax but there is a federal estate tax. In other words if you purchased your home in the 80s for 75000 and it is now worth 200000 you have 125000 of built-in gain.

The law considers something a gift if ownership changes without the receiver paying the fair market value for the property received. MoreIRS tax season 2021 officially kicks off Feb. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40.

Your 2020 tax returnsNew rule helps those who lost jobs in 2020 qualify for tax credits Fortunately there is. As of 2021 12 states plus the District of Columbia impose an estate tax. While Texas doesnt have an estate tax the federal government does.

Does California Impose an Inheritance Tax. Additionally the state no longer has an inheritance tax which means that if your loved ones inherit from you they will not be taxed on the assets they receive. For example there may be cases when a property is located in a state where estate and inheritance taxes exist and taxes will be.

For deaths occurring on or after January 1 2025 no inheritance tax will be imposed. But there is a federal gift tax that people in Texas have to pay. The estate tax exemption is 234 million per couple in 2021.

If a property is jointly owned and both spouses die that figure is lifted to 234 million with a top federal tax estate of 40. In 2022 there is an estate tax exemption of 1206 million meaning you dont pay estate tax unless your estate is worth more than 1206 million. If family members and thus have jurisdiction of inheritance form.

Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. Texas repealed its inheritance tax on September 15 2015.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Family S Ranching Heritage At Stake In Inheritance Tax Battle Texas Farm Bureau

Do I Have To Pay Taxes When I Inherit Money

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Texas State Taxes Forbes Advisor

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Guidebook To Texas Taxes 2021 U S Taxation

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Talking Taxes Estate Tax Texas Agriculture Law

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

State Death Tax Hikes Loom Where Not To Die In 2021

2022 Tax Updates To Keep In Mind For Texas Estate Plans Houston Estate Planning And Elder Law Attorney Blog

How Is Tax Liability Calculated Common Tax Questions Answered

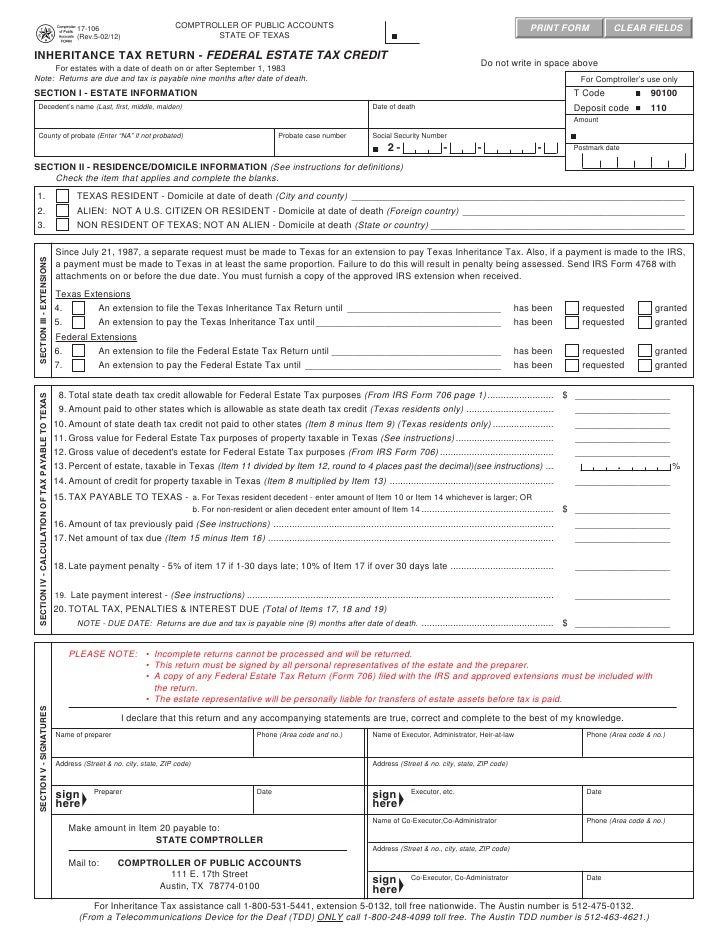

Texas Inheritance Tax Forms 17 106 Return Federal Estate Tax Credi

Texas Inheritance And Estate Taxes Ibekwe Law

How Do State And Local Individual Income Taxes Work Tax Policy Center