is aclu membership tax deductible

The organization is a subsordinate in a grouping ruling. The American Civil Liberties Union ACLU is a 501 c 4 - a tax-exempt social welfare organization that engages in political andor lobbying efforts to further its mission which means donations are treated as membership fees and are therefore not tax deductible.

But the ACLU Foundation is a 501c3 organization just like most nonprofits.

. Yes and No. There is no obligation to pay any capital gains tax on the appreciated value. You can also make a gift in honor or memory of someone special give an ACLU membership to a friend or loved one join the ACLU Impact Society make a tax-deductible gift and more by visiting More Ways to.

The American Civil Liberties Union Foundation ACLU Foundation is a 501 c 3. Membership dues and other gifts to the American Civil Liberties Union are not tax deductible. ACLU monies fund our legislative lobbying--important work that cannot be supported by tax-deductible funds.

A donor may make a tax-deductible gift only to the ACLU Foundation. Membership contributions always fund the Union. As other answers have noted the ACLU proper is a tax-exempt organization per section 501 c4 of the Internal Revenue Code.

The ACLU accepts donations online by telephone 888-567-ACLU or by sending a check to ACLU Membership Department 125 Broad Street 18th floor New York NY 10004. When you make a contribution you become a card-carrying member of the ACLU and the ACLU of Texas and the gift is not tax-deductible. Is my donation tax-deductible.

Renew your ACLU membership today and help us keep fighting for the Constitution and the rule of law. Thus your membership dues supported our successful lobbying efforts in Congress and. Making a gift to the ACLU via a wire transfer allows you to have an immediate.

Donations to the ACLU are not tax deductible while donations the the ACLU Foundation are. Join the ACLU. Make a Tax-Deductible Gift to the ACLU Foundation.

The ACLU of Illinois has been the principal protector of constitutional rights in the state since its founding in 1929. The ACLU is a 501c 4 nonprofit corporation but gifts to it are not tax-deductible. The ACLU is actually two very closely associated institutions the American Civil Liberties Union and the ACLU Foundation.

The ACLUs dual structure is not unusual. Membership dues and other gifts to the American Civil Liberties Union are not tax deductible. Donations to the NYCLU Foundation are tax-deductible to the fullest extent of the law.

All of the ACLU affiliates are 501c3 nonprofits and your donations to any of them would be tax deductible. These organizations are not considered to be charitable organizations under the regulations - that section of the Code is 501 c3 - and therefore contributions made to the ACLU are not deductible as charitable contributions. A donor who chooses to Join and become a card-carrying member of the ACLU is making a contribution to the American Civil Liberties Union.

Over the past year the ACLU has fought against a resurgent wave of extremism in all 50 states. Your membership dues support our legislative advocacy and lobbying work. The American Civil Liberties Union is a 501 a tax -exempt social welfare organization that engages in political andor lobbying efforts to further its mission which means donations are treated as membership fees and are therefore nottaxdeductible.

Your membership dues support our legislative advocacy and lobbying work. Thus your membership dues supported our successful lobbying efforts in Congress and. ACLU Membership not tax-deductible Join the ACLU of Texas a 501c4 non-profit or renew your membership.

The NYCLU Foundations IRS tax ID number is 90-0808294. Become a Member Renew Your Membership. Gifts to the ACLU of Illinois are not tax-deductible.

Were talking about your 2017 taxes. ACLU Membership not tax-deductible Join the ACLU of Northern California a 501 c4 non-profit or renew your membership. A donor may make a tax-deductible gift only to the ACLU Foundation.

Making a gift to the ACLU Foundation via stock or other securities such as bonds or mutual funds allows you to have an immediate impact on the fight for civil liberties. IRS ID or tax ID. The ACLU of Illinois is a 501c 4 organization dedicated to protecting and extending liberty primarily through legislative advocacy.

Now more than ever we need you by our side. This vital work depends on the support of aclu members in all 50 states and beyond. When you make a contribution you become a card-carrying member of the ACLU and the gift is not tax-deductible.

The ACLU Foundation of Maryland is a 501c3 charity which means that contributions are tax-deductible and cannot be used for political. Donations to this entity dont count as tax deductible but you do become a card-carrying member of the ACLU. A donor who chooses to Join and become a card-carrying member of the ACLU is making a contribution to the American Civil Liberties Union.

It is the membership organization and you have to be a member to get your trusty ACLU card. The total value of your gift is tax-deductible as long as it has been held for at least one year. Over the past year the ACLU has fought against a resurgent wave of extremism in all 50 states and thanks to the strength and support of members like you weve.

Because of its lobbying status you cant take a tax deduction for your donations to the ACLU. ACLU monies fund our legislative lobbyingimportant work that cannot be supported by tax-deductible funds. The ACLU is a 501 nonprofit corporation but gifts to it are not tax-deductible.

Contributions to the American Civil Liberties Union are not tax deductible. The main ACLU is a nonprofit known as a 501 c 4 which has the ability to lobbying on behalf of its mission. One thing to keep in mind.

Membership dues and other gifts to the American Civil Liberties Union are not tax deductible. For more information see the ACLU website on this. It is the membership organization and you have to be a member to get your trusty ACLU card.

Now more than ever we need you by our side. The American Civil Liberties Union of Maryland is a 501c4 which means that contributions are not tax-deductible and can be used for political lobbying. Make your tax-deductible gift today and help us fight alongside people whose rights are in severe jeopardy.

What is the NYCLU Foundations Federal Identification Number aka.

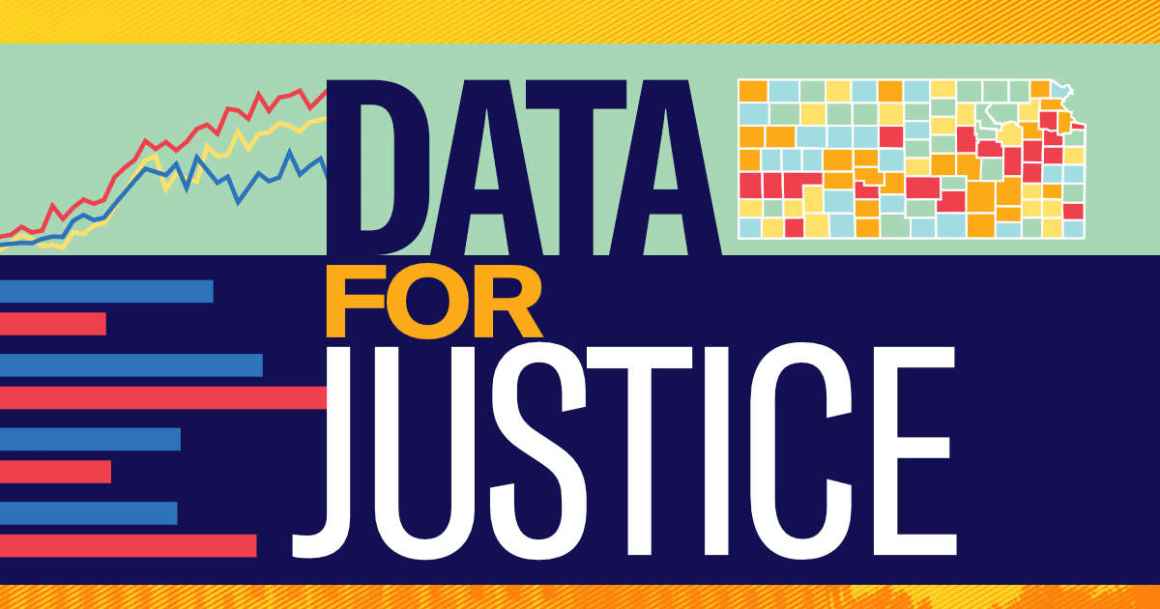

Data For Justice Aclu Of Kansas

Join The Aclu American Civil Liberties Union

How The Aclu Works Howstuffworks

Pin By Wan M On Politics History Current Events Global Dod Family Separation Make A Donation Supportive

Aclu Donations How To Make A Tax Deductible Gift Money

How To Help The Aclu And The Country Aclu Of Illinois

Fundraiser By Shazia Hassam Support The Aclu Refugee Efforts

Give American Civil Liberties Union

Gov Kelly Releases Three Aclu Of Kansas Clemency Project Clients Paving The Way For Many More Such Releases Aclu Of Kansas

Donate To The Aclu Of Florida Aclu Of Florida We Defend The Civil Rights And Civil Liberties Of All People In Florida By Working Through The Legislature The Courts And In The Streets

American Civil Liberties Union Wikiwand

10x10 Join The Fight News Commentary American Civil Liberties Union

Aclu Of Alabama Quick Facts Aclu Of Alabama

Who Is The Aclu Funded By What Is The Aclu Political Ideology Abtc

Update Your Monthly Commitment To The Aclu American Civil Liberties Union